Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- 241.4K All Categories

- 22 >> Start Here <<

- 12 New Members

- 8 FAQs

- 86.6K Gear

- 39.5K Guitar

- 3.4K Acoustics

- 1.3K Bass

- 14.6K Amps

- 17.2K FX

- 266 Digital & Modelling

- 765 Other Instruments

- 8.3K Making & Modding

- 420 Gear Reviews

- 107 Guitar Reviews

- 73 Amp Reviews

- 118 FX Reviews

- 87 Other Reviews

- 748 Made in the UK

- 972 Theory

- 1.8K Technique

- 2.1K Live

- 3.2K Studio & Recording

- 2.1K Making Music

- 218 Events

- 15 Guitar Show 2018

- 829 Plug My Stuff

- 105.1K Classifieds

- 41K Guitars £

- 2.8K Acoustics £

- 138 LH Guitars £

- 896 Basses £

- 10.5K Parts £

- 18.3K Amps £

- 34K FX £

- 2.8K Studio & Rec £

- 6.1K Misc £

- 465 Personnel

- 54.7K Chat

- 36.5K Off Topic

- 1.1K Tributes

- 6.6K Music

In this Discussion

Become a Subscriber!

Subscribe to our Patreon, and get image uploads with no ads on the site!

Help! What's this Sodding Accountant up to?

Bellycaster

Frets: 5854

Bellycaster

Frets: 5854

in Off Topic

3 weeks ago today, I went down to have a free consultation with an Accountant as I'd rather not go through the hell of doing an online return for the first time. It's for my Band earnings which are just over 1.8K for the tax year.

I took all my figures down, my accounts/expenses are piss easy to add up, it could be done on the back of a Fag packet. We negotiated a price of £100 for doing the accounts, although only a verbal agreement, we'd also agreed this on a previous phone call to him while I was seeking out accountants.

So, he worked it all out in front of me, showed me how he could save me some money, which he did, on paper.

He said he'd do the accounts on the Monday of the next working week. I'd not heard from him by the Wednesday of the following week, so I rang him and he said he'd done the accounts, he told me how much I'd owe HMRC over the phone and he also said he would send me all the details through by email, he still hasn't done this and he hasn't phoned me either.

I feel ringing him again would be a waste of time and I don't feel like I want to be nagging him

So, is there a reason for this delay? Is this standard procedure? Has he sent my accounts of to HMRC? Am I just waiting for them to contact me.

I don't want this to drag on and I feel like I am sort of tied into this accountant now and being strung along. This is not good, I just want my fucking taxes doing and I feel like someone is putting me in jeopardy. This is what you get for doing the right thing and trying to be honest.

Can anyone shed any light into what this guy might be up to? Is it the fact that he's doing it cheap and maybe he's having to be crafty or what? Or maybe I'm just not priority enough due to the paltry amount of earnings?

Thanks.

I took all my figures down, my accounts/expenses are piss easy to add up, it could be done on the back of a Fag packet. We negotiated a price of £100 for doing the accounts, although only a verbal agreement, we'd also agreed this on a previous phone call to him while I was seeking out accountants.

So, he worked it all out in front of me, showed me how he could save me some money, which he did, on paper.

He said he'd do the accounts on the Monday of the next working week. I'd not heard from him by the Wednesday of the following week, so I rang him and he said he'd done the accounts, he told me how much I'd owe HMRC over the phone and he also said he would send me all the details through by email, he still hasn't done this and he hasn't phoned me either.

I feel ringing him again would be a waste of time and I don't feel like I want to be nagging him

So, is there a reason for this delay? Is this standard procedure? Has he sent my accounts of to HMRC? Am I just waiting for them to contact me.

I don't want this to drag on and I feel like I am sort of tied into this accountant now and being strung along. This is not good, I just want my fucking taxes doing and I feel like someone is putting me in jeopardy. This is what you get for doing the right thing and trying to be honest.

Can anyone shed any light into what this guy might be up to? Is it the fact that he's doing it cheap and maybe he's having to be crafty or what? Or maybe I'm just not priority enough due to the paltry amount of earnings?

Thanks.

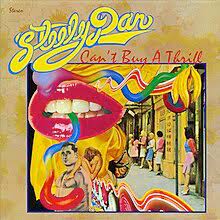

Only a Fool Would Say That.

0 LOL 0

LOL 0 Wow! 0

Wow! 0 Wisdom

Wisdom

LOL 0

LOL 0 Wow! 0

Wow! 0 Wisdom

Wisdom Base theme by DesignModo & ported to Powered by Vanilla by Chris Ireland, modified by the "theFB" team.

Comments

I'm new to dealing with these people, it's irritating and chipping away at me.

On second thoughts, they dont even need to be half-decent.

So what happens now if I phone him and give him a round of Fucks, tell him to get lost, can he demand payment from me. I never signed anything.

I think the amount he estimated was around £180, which is about 10% of the earnings, rather than the 20% standard.

If you haven’t signed anything I’d tell him to do one. It’s not hard to file a tax return if your income is straightforward. You’ve already done the hard part putting the figures together. File it online yourself and you’ll have unti end of Jan next year.

https://www.studiowear.co.uk/ -

https://twitter.com/spark240

Facebook - m.me/studiowear.co.uk

Reddit r/newmusicreview

Rift Amplification

Brackley, Northamptonshire

www.riftamps.co.uk

What is "Deckering it"?

I might be low priority, but it's putting my nerves on edge and I want it done and dusted. It's on my mind and bothering me. No wonder people just don't fucking bother declaring.

Just reading the hmrc website gives me headaches.

I had to look recently and from what I can see on the gov website under tax and money, I’ve found this.

Everyone in a normal average paid employed job gets a tax free allowance of £11,850 per year.

If like me, your earnings dont exceed that in a tax year, you don’t pay any tax.

I can unfortunately vouch for that.

I tried being ‘self employed’ for a year on top of my normal job. So I had to do self assessment and hope that hmrc just worked it all out and took some tax off me for both jobs, as my earnings could likely then exceed £11,850.

Well I never had that problem anyway because lifes shit..

But on the same webpage it says ‘you may also have tax free allowances for your first £1000 of income from self employment, which is your trading allowance’

So I presumed I could earn up to £1000 in this self employed role and not pay any tax on it, even if it pushed my total cumulative income from both self employment and my retail job, over the personal allowance of £11,850 for a tax year..

In the end I just had enough.

I wrote to hmrc and said look,

’I’m clearly a fucking unemployable thicko, so obviously I can’t get my head around this confusingness of allowances and tax and big words’

I said ‘ i hereby pass this buck to you. This is my declaration, its now on you to ensure I pay my tax correct because I lack the capacity to do so for myself, so read on and just work out shit for me.’

‘I have an employed job, I dont earn enough to pay tax on it though.

But This year I earned an extra £900 driving ambulances as ‘self employed’, so do I even need to inform you of that?’

I can’t remember their reply, but whatever they said it was that basically I didnt need to take action.

I’m certain they linked me to their website which had a page covering ‘casual income’, which stated how much you can earn extra to your normal job and not need to declare in a year. But I can’t find it for love nor money now, so I guess they’ve changed that.

One thing I do know is, cover your back.

My Stepdad recently got hit for near £8k (he’s now semi retired and about 65).

Hmrc wrote to him demanding the money he ‘owed’ because they’ve been going back and checking stuff.

Stuff from his days of working for LFB as an active fireman.

So long ago was his career with them, he still has the wooden handled axe they would carry on duty. Thats how far back the taxman looks when they want to.

https://www.studiowear.co.uk/ -

https://twitter.com/spark240

Facebook - m.me/studiowear.co.uk

Reddit r/newmusicreview

@Bellycaster if you ring HMRC they will be able to tell you if the return has been filed. Also, regardless of how much you've paid or how much turnover you have you should have been shown figures etc before anything is filed. If it was right up to the deadline we might file a return without the okay from the client but we will always try to contact them first and, at the very least, email them a copy of what we have filed.

I'd keep pestering him for copies of everything as well as a full breakdown of the figures he's put on the return if he's not prepared an actual set of accounts to go with it (we would do a set of accounts in this instance but mainly because it's the easiest way to get the info onto the software). They are your figures not his. You have a right to know exactly what is on your return.

If he has filed the return and isn't forthcoming with documents there are a couple of things you can do.

1. Get a copy of the return from HMRC - explain the situation to them and I'm sure they'll be helpful.

2. Fairly drastic but find out which body issues the firm's practicing certificate (most likely ICAEW but there are others) and make it clear to the firm (not just the accountant in question) that you will raise an issue with ICAEW. Size of job and bill do not effect the responsibilities the firm has to you as a client. Might all be moot if he's a one man band with no qualifications but, from what you've said, I don't necessarily get that impression.

If for any reason you aren't happy with what has been filed you can submit an ammended return without penalty.

Happy to help out with anything you get sent if needed.

A very good detailed breakdown there. I would dread to have to ring HMRC though, that can be painful

He does have my UTR as well, I supplied him with that at the time.